WORLD OF INDUSTRIES 4/2019

- Text

- Industries

Modest growth outlook

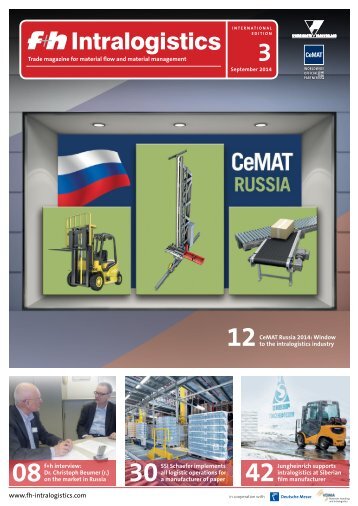

Modest growth outlook for Russia, but opportunities to gain market share in various unorganized industry sectors Year on year, Russian economy is getting robust, as they find out ways to tackle external issues like sanctions, drop in oil prices or currency crisis. As the economy prepares itself with significant fiscal buffers, the internal demand, consumption and exports increases, thus boosting the demand for services like transportation, warehousing, and complete logistics solutions. Russia’s real GDP growth in 2018, reached nearly 2.5 %, surpassing the general expectations, mostly due to the one-off effects of energy sector. Growth forecasts for 2019-21 is between 1.2-1.8 %, this reflects a more modest outlook in line with Russia’s current potential growth of about 1.5 %. In the first quarter of 2019, GDP growth slowed for several reasons, mainly due to Russia agreeing on cutting down oil production along with other OPEC members, a tighter monetary policy and an increase in VAT rate from 18 % to 20 %. Instead of annual growth rates, let’s take a look at Russia’s potential growth rate, as this depicts a more accurate picture about the economy. In the last 10 years, potential growth all over the world has slowed, so Russia experiencing this slow down is nothing out of the normal. In the last 5 years, potential growth was below its longer-term average in most of advanced as well as emerging economies. However, the slowdown had a more serious impact in Russia, as it highlighted a weak productivity related growth and worsening demographics. Based on data from world bank, Russia’s potential growth is set to gradually decline from 1.5 % in 2017 to 1.3 % by 2024. Russia seems to have undertaken certain reforms in-order to reverse this declining trend. Reforms that are focused on bringing more inward migration, higher investment, and increasing productivity, increasing in retirement age etc. If Russia succeeds in executing these reforms then it could bring about an increase of 1.5 % in potential growth within the next 10 years. Of all the factors men- Author: Sushen Doshi, International Correspondent for World of Industries NEWS AND MARKETS

tioned above, increase in productivity is the key driving factor, which has maximum impact on Russia’s potential growth. In order to increase productivity in such short span, Russia needs to heavily invest on innovation, skills and competition. Downside and Upside Downside risks to Russia’s medium-term growth outlook arise from the risk of deepening of economic sanctions, financial crisis in emerging markets, a deteriorating global trade environment due to trade war between US and China, and a dramatic drop in oil prices. Russia also suffers due to its limited portfolio of exports. For more than 30 years, oil, natural gas and energy products have been Russia’s largest exports. Through continued efforts from the government since 2014, growth in non-energy export volumes has been outpacing that of energy and contributing to export diversification. But despite this, Russia’s export portfolio is shallow, with the share of oil/gas products still totaling close to 60 %. In the last few years, Russia has prepared itself quite well for reducing the impact of external shocks and volatility of the commodity prices on it’s economy. Another area where Russian macro-economic strengths lie is the low public and external debts, no fiscal deficits, in-fact significant fiscal surpluses. On the upside, government has launched multiple national projects aimed at strengthening human capital and increasing productivity, if well-implemented, could positively affect Russia’s potential growth in the medium-term. Also, changes in labor legislation, with focus more on formalization of workforce is a strong step as it could benefit the economy by 2.5 % of the GDP. The share of informal labor is quite high in Russia, it is estimated to range between 15-20 %. Russia continued its efforts to improve the business and regulatory environment for SME sector by carrying out reforms in the areas such as getting faster permits for construction, electricity connections, paying taxes became less costly by allowing a higher tax depreciation rate for immovable assets, and cross border trading was improved with less bureaucracy and online customs clearance facility. As a result of this, Russia advanced to 31st place in the global ease of doing business ranking, representing an improvement from the 35th place last year and ranked 120th seven years ago. Russia’ logistics sector overview After struggling for years, growth and optimism has finally returned to the nation’s transport and logistics sector. From 2018 the industry saw a return to the high levels of freight entering and exiting Russia. Russia is stepping up both its exports and imports it receives from non-sanctioned trade partners. China, which is Russia’s second largest trading partner after the European Union, is keen to bump up Russia bound exports, and Russia is ready to reciprocate. And this brings with it enhanced opportunities for foreign companies, not just in terms of pure investment, but also as a market to sell transport services and technologies. With the rise of e-commerce industry, the market for 3pl service is expected to witness significant growth. As competition amongst manufacturers increases, they aim to focus more of their resources on their core competencies and outsource the logistics part of the operation to professional third party service providers. This is set to escalate the demand for 3pl service. Moreover, the 3pl services have a larger role to play as gains in productivity, reliability, and significant reductions in cost can be derived. Let’s take a look at the market situation of logistics service providers in the country. Revenues generated by the sector reached around $ 17 billion in 2015 and $ 19 billion in 2017. Russia’s third party market is by far the largest in the CIS region, which is collectively valued more than $ 25 billion. Outsourcing of transportation services takes roughly of a fifth of market share in Russia. Comparatively, 3pl service providers cover more than two thirds of the European and almost half of China’s market. There are roughly 4000-6000 logistics companies in Russia. Out of these, only 100 can really be considered true third party logistics service providers. Some of the big names include Eurosib, Nienshants Logistics, STS Logistics and a subsidiary of Russia’s railway, RZD Logistics. The unsaturated nature of the market means international firms are well positioned to progress in Russia. Firstly due to the fact that 3pl as an industry is a fairly new phenomenon in post-Soviet Russia, many Russian companies handle transportation in-house. Most of domestic firms also struggle to meet international service standards, this gives foreign firms a competitive edge. The fact that the Russian outsourced transport sector is relatively unorganized creates space for international companies to expand. So, third party logistics sector in Russia is currently underdeveloped, ready to expand and fertile ground for international companies to grow their Russian operations. Photographs: Lead Photo Fotolia WORLD OF OF INDUSTRIES 4/2019 9 Turkish Machinery.indd 1 14.08.2019 11:01:35

- Page 1 and 2: 04/2019 www.world-of-industries.com

- Page 3 and 4: EDITORIAL World in Transition Confo

- Page 5 and 6: 10 AUTOMATION 27 BARLEY MALT PRODUC

- Page 7: Rittal, Atos and Siemens form a glo

- Page 11 and 12: IT, including cyber-security; High-

- Page 13 and 14: 01 At Cemat, visitors can find late

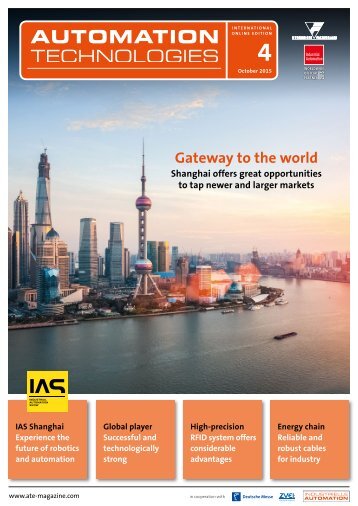

- Page 15 and 16: make Shanghai a great business dest

- Page 17 and 18: Connectivity for all dimensions Rob

- Page 19 and 20: There are currently stores around 7

- Page 21 and 22: 01 02 03 Obtaining qualified insigh

- Page 23 and 24: Easy gear unit selection thanks to

- Page 25 and 26: Robot cables have to withstand seve

- Page 27 and 28: Barley malt producer increases prod

- Page 29 and 30: 02 Efficiently wired: Single-pair a

- Page 31 and 32: to its digital signal processing ca

- Page 33 and 34: A high-tech drinks mixer showcases

- Page 35 and 36: Digital future must be actively sha

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...