f+h Intralogistics 5/2014

- Text

- Fuh

- Intralogistics

Indian Market India: the

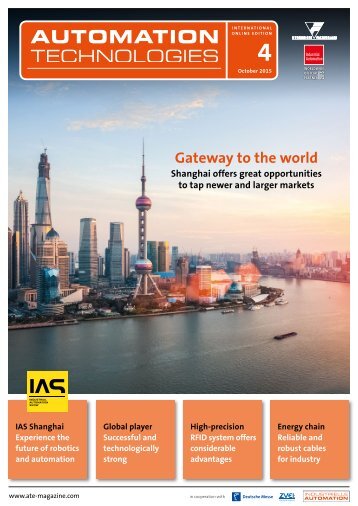

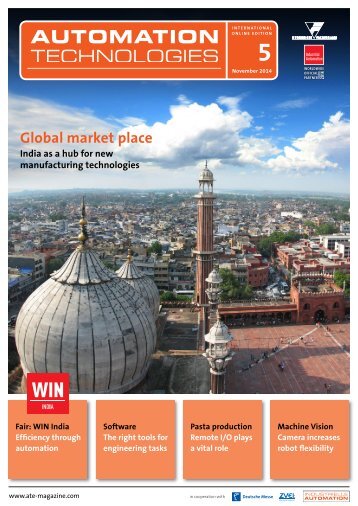

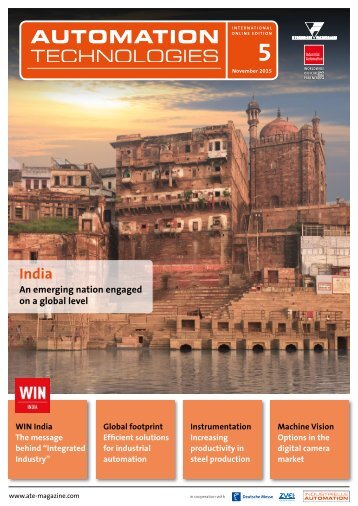

Indian Market India: the “sweet spot” among BRICS National elections in 2014 brought dramatic change to India’s political scenario and created renewed optimism about its economy. The Bharatiya Janata Party (BJP), led by Prime Minister Narendra Modi, quashed all opposition on the way to winning a majority in the Parliament. Modi has a stellar track record of economic development and industrial growth in Gujrat, a state where he was the Chief Minister from 2001 to 2014. As such, his ascension to the Prime Minister’s post is being viewed as a major positive for reforms and growth in India. Falling crude prices and a stabilizing Indian Rupee have lifted India’s economic prospects in recent times. The Indian stock market is trading close to its all-time high with key equity indices, Sensex and Nifty, clocking more than 25 % growth since the start of 2014. In contrast, emerging economies, such as China and Russia are clearly slowing down. China recently posted its weakest GDP (Gross domestic product) growth since the 2008 financial crisis, while Russia continues to reel under economic sanctions and falling crude prices. Other key emerging economies, such as Brazil, Indonesia and South Africa are also under severe stress due to softening commodity prices and the Chinese slowdown. India being a net commodity importer running a perennial trade deficit, continues to benefit in such a scenario. As a result, the Indian economy is swiftly turning into the most attractive destination for global investors in search of growth. Major boosts for India’s economic prospects A global supply glut in crude oil and commodities coupled with moderating global demand (particularly in the euro zone and China) is once again threatening to derail 10 f+h Intralogistics 5/2014

Indian Market blocks recently scrapped by the Supreme Court. Moreover, divestment of stakes in state-run companies is high on the priority list and we can expect stake sales for companies like ONGC (Oil and Natural Gas Corporation), Coal India, REC (Rural Electrification Corporation), PFC (Power Finance Corporation), SAIL (Steel Authority of India), etc. in the near future. The government has set a target to raise .5 billion from divestments in the current fiscal year. It will be key to shoring up India’s public finances and reducing its large fiscal deficit. It will also aid infrastructure development in the country for which the new government has or introduced in most sectors now, ranging from defence to food processing. As a result, FY2015 (Fiscal Year) is expected to bring the highest ever FDI to India, surpassing the previous record of billion achieved in FY2011-12. The world should “make in India” More important than FDI for foreign investors is the present government’s focus on making it easier to do business in India and acquire land. Several reforms are being deliberated for removing the several obstacles “National elections in 2014 created renewed optimism about India’s economy” Michael Weidner global economic growth. However, these very forces are proving to be a boon for India’s domestic economy. Being a net importer of crude and other industrial commodities, India has been running a trade deficit for years. Rising commodity prices hurt the Indian economy through higher inflation and higher interest rates. Moreover, government’s finances suffer due to increased subsidies, which results in lower spending on infrastructure and social welfare. “In the current scenario, market forces are set to lower India’s inflation, interest rates and improve public finances”, so Michael Weidner, management at Löwenstein & Partner, Germany. Key economic reforms implemented The first NDA (National Democratic Alliance) government from 1999 to 2004 is widely credited for ushering in an era of radical, pro-market reforms. There are similar expectations from the present NDA government too, and the process has already started. Diesel prices have been freed from government control. The government has also ordered auctions of coal ambitious plans. These include: n modernization and revamping of Railways, n time-bound programme for execution of national highway projects, n low-cost airports in smaller cities, n modernization of existing ports and development of new world-class ports. India’s public distribution system is also set for a revamp as the government tries to curb food inflation and reduce wastage of farm produce. The Prime Minister made two very important statements since assuming office: n He has urged global investors to ‘make in India’ n FDI for him means ‘First Develop India’. It is evident that he wants to create jobs and develop India by making it a manufacturing hub. The government has already permitted 100% FDI (Foreign Direct Investment) in railways. Besides, FDI limit in defence sector has been hiked to 49 % and FDI in the insurance sector is being raised to 49%. In fact, FDI norms are being relaxed About Löwenstein & Partner that stand in the way of getting clearances and permissions. India is currently ranked 134 out of 189 countries in the World Bank’s Ease of Doing Business Index. The aim is to be in the top 50 of that list by introducing “radical measures on a war footing”, as per an agenda note prepared by the Department of Industrial Policy and Promotion (DIPP). The DIPP has identified eight areas that need de-bottlenecking immediately – starting a business; dealing with construction permits; getting electricity; registering property; paying taxes; enforcing contract and resolving insolvency. Besides, reforming labour laws is also high on the agenda. In conclusion, India today is poised to move in a positive direction compared to the last 10 years. Global market forces have helped stabilize the economy. Concurrently, reforms in governance, legislation and economic policy are creating a favourable investment destination for foreign investors. Photos: Fotolia, Löwenstein & Partner www.loewenstein-und-partner.de Löwenstein & Partner is a professional services firm which acts as a one-stop shop for companies and entrepreneurs looking to establish and operate a business in India. The company retains a team of experts with deep understanding of the business dynamics in India and the intricacies of doing business there. Löwenstein & Partner provide goal-oriented research, analysis and advisory services to smoothen the road for foreign investors to set up a presence in India, be it green field investments, acquisitions or strategic alliances. The team of the services firm is present in Germany and India, which gives them an edge in appreciating the cultural and socio-economic diversity in so far as it relates conducting business in India. f+h Intralogistics 5/2014 11

- Page 1 and 2: Intralogistics Trade magazine for m

- Page 3 and 4: table of content Intralogistics Tra

- Page 5 and 6: EDITORIAL Intralogistics Trade maga

- Page 7 and 8: ‘Best in Class Winner’ Junghein

- Page 9: SOME THINK DELIVERY ERRORS ARE INEV

- Page 13 and 14: Interview I indian market areas of

- Page 15 and 16: CEMAT INDIA latest news of procedur

- Page 17 and 18: Hercules Hoists Ltd ... ... is a on

- Page 19 and 20: Logistics management Segment-specif

- Page 21 and 22: Interview I Logistics management ex

- Page 23 and 24: material flow Crisplant is known fo

- Page 25 and 26: Material flow About CTI Systems CTI

- Page 27 and 28: Warehousing tious targets. Essentia

- Page 29 and 30: and Intralogistics warehousing tech

- Page 31 and 32: Warehousing In food-logistics, the

- Page 33 and 34: Product News Supply battery changin

- Page 35 and 36: Efficient Warehouse Systems As a fu

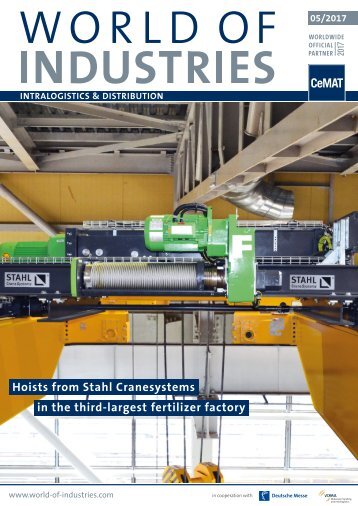

- Page 37 and 38: Cranes and hoists 01 The logistics

- Page 39 and 40: Cranes and hoists 01 Automatic proc

- Page 41 and 42: Vanderlande helps to boost revenue

- Page 43 and 44: Technology knowledge for engineers

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...