f+h Intralogistics 4/2015

- Text

- Fuh

- Intralogistics

INVESTMENT POLICY 02

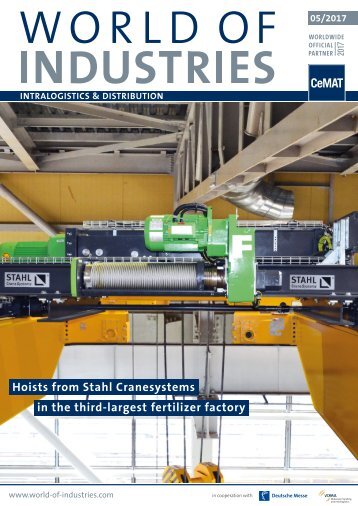

INVESTMENT POLICY 02 What should the Russian government do during “EU sanctions periods”? volume of meat and dairy products to Russia and is now registering a considerable decrease in exports. With regard to fresh fruits and vegetables, Southern European countries are most affected. Greece, Spain but also Poland announce large surplus quantities of fresh fruits and vegetables, products that used to go to Russia. Also Czech and Slovakian machine builders had to absorb order losses. The negative effects of the economic sanctions against Russia and the Russian government’s countermeasures are also noticeable in the Italian economy [5]. At the same time, local producers, but also manufacturers from countries that are not within the scope of the sanctions regulations profit. According to Alexej Koslow, senior analyst at UFS IC, an international investment company, there are some winners benefitting from the Russian embargo against foodstuffs. “Turkey, Armenia, Georgia and several South American countries as well as Russian producers profit from the import ban.” [6]. Export control and customs regulations in the EU states What are the challenges for companies exporting to Russia? Sanctions are legally binding, any violation constitutes an offence, violators face high penalties. A violation can be punished with a fine up to EUR 500,000. In addition, the turnover generated through the transaction may be confiscated. If the sanction regulations are violated intentionally, this may lead to imprisonment for up to 15 years. Which goes to prove that with exports to Russia, extreme care is indispensable; the company’s internal export control plays a decisive role here. If you want to export to Russia, it is recommended to observe the following rules (Image 01): n Check the consignee in Russia (e. g. via www.finanz-sanktionsliste.de) n There is an export ban on all arms named on the Common Military List of the European Union. It corresponds with Part I A of the German export list. n The export of dual-use goods to Russia to certain consignees specified in Appendix IV (Council Directive (EU) No. 960/2014 dated 8 Sept 2014) is prohibited. As an exception, these goods may be exported to Russia if they are meant for use in the space and aeronautics industry. n If dual-use goods serve a military purpose or are intended for a military end user in Russia, export is prohibited. n Dual-use goods are all goods specified in Appendix I of the EU Dual-Use Goods Directive (listed dual-use goods). n Russia is now a weapons embargo country. If the goods to be exported have a corresponding final use reference, the export even of non-listed goods requires a permit from BAFA, the Federal Office of Economics and Export Control. The forms of military end use are defined in Article 4 of the EU Dual-Use Goods Directive. n Mind Appendix II. Some equipment and technology for oil production has to be approved for export by BAFA. The goods in Additional links [1] www.bit.ly/GTAI_russland_sanktionen_einfuehrverbot [2] www.bit.ly/finanzen_russland_sanktionen [3] www.bit.ly/russland_und_eu_sanktionsspirale [4] www.bit.ly/finanzen_vermoegensverwalter [5] www.bit.ly/GTAI_russland_sanktionen_auswirkungen [6] www.bit.ly/russland_wirtschaft_lebensmittel_embargo [7] www.bit.ly/russland_sanktionen_ihk_report [8] www.bit.ly/german_mittelstand_in_russland [9] www.bit.ly/GTAI_russland_sanktionen_auswirkungen [10] www.bit.ly/sonderwirtschaftszonen_russland [11] www.bit.ly/hik_sonderwirtschaftszonen_russland About M&M Militzer & Münch The Militzer & Münch Group employs a staff of about 2,000 at 100 locations in over 25 countries. Strategic partnerships in numerous other countries complete the dense network. Militzer & Münch offers worldwide air and sea freight services as well as road and rail transports and project logistics along the East-West axis in Eurasia and North Africa as well as air and sea freight world-wide. The Group operates with a dense network of branch offices in Eastern Europe, the CIS, the Middle East and the Far East as well as in the Maghreb countries. The head office of the company that goes back to 1880 is in Sankt Gallen, Switzerland. 10 f+h Intralogistics 4/2015

INVESTMENT POLICY question are specified in Appendix II of Directive (EU) No. 833/2014 [7]. Forecast – What is the future of Russian business? The sanctions have caused significant economic problems for the Russian Federation. Economic performance is decreasing, demand declining. A severe recession – the result of the Russian Government’s inadequate economic policy – is exacerbating the situation. Moreover, Russia is facing an enormous financing crisis; the sinking oil prices and the devaluation of the ruble are obstructing government investment programs. Urgently needed reforms have been delayed, big projects that traditionally used to stimulate economy are being postponed or even discarded completely. To this day, the Russian economy is not yet diversified enough to fully compensate for the loss of imports. Due to the import restrictions as well as purchasing and financing bottlenecks, the sales figures of European manufacturers in Russia in the field of mechanical engineering and plant engineering, in the automotive industry, the food industry and among suppliers of agricultural products have gone down significantly [8]. From the European exporters’ perspective it remains to be seen how the economic relations will develop. Currently, European companies are showing caution and try to minimize risks. What counts here, especially, is keeping an eye on the EUR/RUB exchange rate. Parties exporting from Europe to Russia should pay closely monitor the exchange rate fluctuations and critically asses and take into account the connected risks [9]. Looking for new strategic partners to support modernization and assist in the implementation of infrastructure projects, Russia is increasingly turning to the East. According to a survey by the Levada Analytical Center, the Russian population welcomes the stabilization, reinforcement and expansion of the cooperation with China, India and the Near East countries as sensible (Image 02 – survey conducted between 19 June 2015 and 22 July 2015 / 800 respondents from 46 Russian regions). There are, however, also positive trends to be observed in the current situation. The magic word here is “localization” – “Made in Russia”. European manufacturers build their own production plants in Russia and produce locally. Not only does localization allow circumventing existing sanctions legally, it offers a decisive advantage into the bargain: low production costs not only owing to low wages but also thanks to low purchasing prices. The end product then sells cheaper on the national market, sales figures rise, and turnover rises with them. Renowned German companies such as Daimler or Bosch are currently investing in new production sites on Russian soil. Special economic zones, too, attract foreign companies aiming to relocate production to Russia. Currently, there are more than 20 economic zones based on different models [10]. They offer many benefits to foreign companies. Starting from exemption from wealth and land taxes to low-cost lease rates for property to minimized profit taxes including even federal guarantees for the investments made [11]. For Russia, an innovative business approach to stimulate the development of the economy. Chartes/Photos: Lead photo Fotolia/processing: VFV Grafik, 01 – 02 Militzer & Münch www.mumnet.com Click to read previous issues. Inspiration is just one click away. Welcome to our stand on CeMAT Russia pavilion 3, hall 13, stand A401 • More than 5 000 stock items in Russia • Technically-skilled employees • Assistance in Russian language • Payments in roubles • One-stop shop All parts, all makes News about the following markets: OOO TBX PУC 141580, Russian Federation • Moscow region Solnechnogorsky area Rural settlement Lunevskoe near Dubrovka village Aeroportovskaya St., bld. No. 5 T+7 495 739 44 82 • sales.tvhrus@tvh.com TVH PARTS NV • PARTS & ACCESSORIES DIVISION Brabantstraat 15 • BE-8790 Waregem T +32 56 43 42 11 • F +32 56 43 44 88 parts@tvh.com • f+h www.tvh.com Intralogistics 4/2015 11

- Page 1 and 2: Intralogistics Trade magazine for m

- Page 3: TABLE OF CONTENT 06 News an informa

- Page 6 and 7: Worldwide News Additional huge join

- Page 8 and 9: INVESTMENT POLICY The sanctions and

- Page 12 and 13: GLOBAL BUSINESS Hellmann expands in

- Page 14 and 15: CEMAT RUSSIA NEWS Opportunities in

- Page 16 and 17: CEMAT RUSSIA NEWS part of this. The

- Page 18 and 19: INTRALOGISTICS Specific solutions f

- Page 20 and 21: INTRALOGISTICS Intralogistics at Bi

- Page 22 and 23: MATERIAL FLOW Well maintained lasts

- Page 24 and 25: MATERIAL FLOW often parts have been

- Page 26 and 27: MATERIAL FLOW Tugger train solution

- Page 28 and 29: MATERIAL FLOW 02 Source pallets wit

- Page 30 and 31: MATERIAL FLOW Mechanized unloading

- Page 32 and 33: MATERIAL FLOW 03 With their special

- Page 34 and 35: PACKAGING TECHNOLOGY A comparison o

- Page 36 and 37: PACKAGING TECHNOLOGY requires a lot

- Page 38 and 39: WAREHOUSING Grob relies on automate

- Page 40 and 41: SOFTWARE Bringing complex process a

- Page 42 and 43: INDUSTRIAL TRUCKS I FORKLIFT TEST R

- Page 44 and 45: INDUSTRIAL TRUCKS I FORKLIFT TEST 0

- Page 46 and 47: CRANES & HOISTS SABETTA HAMBURG KÜ

- Page 48 and 49: CRANES & HOISTS cal expertise but i

- Page 50 and 51: CRANES & HOISTS The Demag KBK Aluli

Inappropriate

Loading...

Mail this publication

Loading...

Embed

Loading...